Private Equity and Hedge Funds After the Global Financial Crisis: A Long-Term Perspective

4.3 out of 5

| Language | : | English |

| Paperback | : | 68 pages |

| Item Weight | : | 5.1 ounces |

| Dimensions | : | 5.83 x 0.16 x 8.27 inches |

| File size | : | 783 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 380 pages |

| X-Ray for textbooks | : | Enabled |

Private equity and hedge funds are two types of alternative investments that have been growing in popularity in recent years. Private equity funds invest in private companies, while hedge funds invest in a variety of assets, including stocks, bonds, and commodities. Both types of funds offer the potential for high returns, but they also carry significant risks.

The global financial crisis of 2008-2009 had a major impact on the private equity and hedge fund industries. Many funds lost significant value during the crisis, and some even failed. However, the industry has since rebounded, and both private equity and hedge funds have continued to attract new investors.

In this article, we will provide an overview of the private equity and hedge fund industries, discuss their performance since the global financial crisis, and consider their future prospects.

Private Equity

Private equity funds invest in private companies, which are not publicly traded on stock exchanges. Private equity firms typically use leverage to finance their investments, which can magnify both the potential returns and the risks.

Private equity funds have been around for decades, but they have become increasingly popular in recent years. This is due in part to the low interest rates that have prevailed since the global financial crisis. Low interest rates make it cheaper for private equity firms to borrow money, which allows them to invest more aggressively.

Private equity funds can invest in a variety of companies, from small startups to large, established businesses. They typically focus on companies that they believe have the potential for significant growth. Private equity firms often work with the management teams of the companies they invest in to help them improve their operations and increase their value.

The returns from private equity funds can be very high. However, they are also very risky. Private equity funds typically have long lock-up periods, which means that investors cannot withdraw their money for several years. This can be a problem if the fund does not perform well.

Hedge Funds

Hedge funds are investment funds that use a variety of strategies to generate returns. Hedge funds often use leverage, which can magnify both the potential returns and the risks.

Hedge funds have been around for decades, but they have become increasingly popular in recent years. This is due in part to the low interest rates that have prevailed since the global financial crisis. Low interest rates make it cheaper for hedge funds to borrow money, which allows them to invest more aggressively.

Hedge funds can invest in a variety of assets, including stocks, bonds, and commodities. They often use complex trading strategies that are designed to generate alpha, which is the excess return over and above the market benchmark.

The returns from hedge funds can be very high. However, they are also very risky. Hedge funds often have high fees, which can eat into their returns. Additionally, hedge funds can be very volatile, which means that they can lose value quickly.

Performance Since the Global Financial Crisis

The global financial crisis had a major impact on the private equity and hedge fund industries. Many funds lost significant value during the crisis, and some even failed. However, the industry has since rebounded, and both private equity and hedge funds have continued to attract new investors.

Private equity funds have performed well since the global financial crisis. According to the Private Equity Growth Capital Council, the median net internal rate of return (IRR) for private equity funds that were raised in 2008 was 12.1%. This is higher than the 10-year average IRR for private equity funds of 10.9%.

Hedge funds have also performed well since the global financial crisis. According to the Hedge Fund Research HFRX Global Hedge Fund Index, the median hedge fund returned 8.2% in 2021. This is higher than the 7.2% return for the S&P 500 Index.

Future Prospects

The future prospects for the private equity and hedge fund industries are positive. Both types of funds are expected to continue to attract new investors, and their returns are expected to remain strong.

There are a number of factors that are driving the growth of the private equity and hedge fund industries. These factors include:

* Low interest rates * Increased demand for alternative investments * Growing wealth of high net worth individuals and family offices

Low interest rates make it cheaper for private equity and hedge funds to borrow money, which allows them to invest more aggressively. Increased demand for alternative investments is due to the low returns that are available from traditional investments such as stocks and bonds. Growing wealth of high net worth individuals and family offices is also driving the growth of the private equity and hedge fund industries, as these investors are looking for ways to diversify their portfolios and generate higher returns.

Despite the positive outlook for the private equity and hedge fund industries, there are a number of risks that investors should be aware of. These risks include:

* Economic downturn * Rising interest rates * Increased regulation

An economic downturn could lead to a decline in the value of private equity and hedge fund investments. Rising interest rates could make it more expensive for private equity and hedge funds to borrow money, which could reduce their returns. Increased regulation could also make it more difficult for private equity and hedge funds to operate.

Private equity and hedge funds are two types of alternative investments that can offer the potential for high returns. However, they also carry significant risks. Investors should carefully consider their investment objectives and risk tolerance before investing in private equity or hedge funds.

4.3 out of 5

| Language | : | English |

| Paperback | : | 68 pages |

| Item Weight | : | 5.1 ounces |

| Dimensions | : | 5.83 x 0.16 x 8.27 inches |

| File size | : | 783 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 380 pages |

| X-Ray for textbooks | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Page

Page Chapter

Chapter Story

Story Genre

Genre Library

Library Paperback

Paperback Sentence

Sentence Bibliography

Bibliography Annotation

Annotation Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Biography

Biography Encyclopedia

Encyclopedia Thesaurus

Thesaurus Character

Character Resolution

Resolution Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Borrowing

Borrowing Archives

Archives Study

Study Research

Research Scholarly

Scholarly Lending

Lending Journals

Journals Rare Books

Rare Books Special Collections

Special Collections Interlibrary

Interlibrary Literacy

Literacy Study Group

Study Group Thesis

Thesis Reading List

Reading List Book Club

Book Club Theory

Theory Priyankee Saikia

Priyankee Saikia Denniger Bolton

Denniger Bolton Sean Yue

Sean Yue Timothy J Demy

Timothy J Demy Laura Martin

Laura Martin J Smith

J Smith Posy Lovell

Posy Lovell Paul W Schroeder

Paul W Schroeder Lauren Palphreyman

Lauren Palphreyman Izabella Brooks

Izabella Brooks Michele Bachmann

Michele Bachmann Tilly Wallace

Tilly Wallace Pat Hughes

Pat Hughes Gabrielle Kent

Gabrielle Kent Judy Bartkowiak

Judy Bartkowiak David A Lossos

David A Lossos David Robert Burleigh

David Robert Burleigh Karin Bijsterveld

Karin Bijsterveld Jenessa Fayeth

Jenessa Fayeth Dermot Berkery

Dermot Berkery

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Adrien BlairComparative Government and Politics by John McCormick: A Comprehensive Review

Adrien BlairComparative Government and Politics by John McCormick: A Comprehensive Review Don ColemanFollow ·4.6k

Don ColemanFollow ·4.6k Garrett PowellFollow ·2.7k

Garrett PowellFollow ·2.7k Camden MitchellFollow ·11.3k

Camden MitchellFollow ·11.3k Ronald SimmonsFollow ·7.4k

Ronald SimmonsFollow ·7.4k Jacques BellFollow ·19.6k

Jacques BellFollow ·19.6k Israel BellFollow ·19.7k

Israel BellFollow ·19.7k Reed MitchellFollow ·12.6k

Reed MitchellFollow ·12.6k Reginald CoxFollow ·14.5k

Reginald CoxFollow ·14.5k

Anton Chekhov

Anton ChekhovClarinet Fundamentals: A Systematic Fingering Course for...

Welcome to the exciting world of...

Gage Hayes

Gage HayesSea Prayer: A Haunting and Heartbreaking Story of...

Sea Prayer, the latest...

Henry Green

Henry GreenPillars of Society Rosmersholm Little Eyolf When We Dead...

Henrik Ibsen, the towering...

Robert Reed

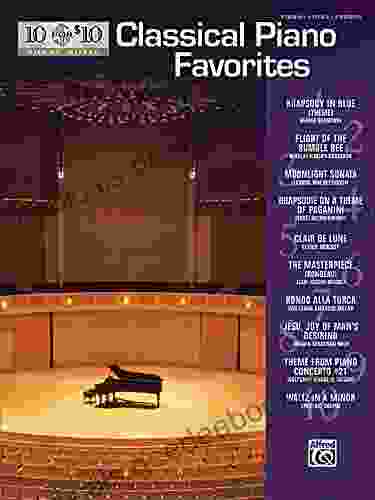

Robert Reed10 For 10 Sheet Music Classical Piano Favorites: A...

Learning to play the...

4.3 out of 5

| Language | : | English |

| Paperback | : | 68 pages |

| Item Weight | : | 5.1 ounces |

| Dimensions | : | 5.83 x 0.16 x 8.27 inches |

| File size | : | 783 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 380 pages |

| X-Ray for textbooks | : | Enabled |