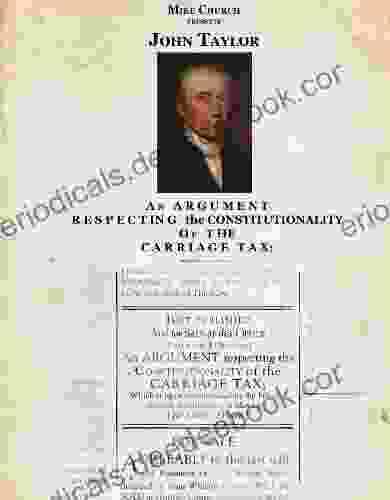

An Argument Respecting the Constitutionality of the Carriage Tax

The Carriage Tax was a tax on carriages that was passed by the United States Congress in 1794. The tax was unpopular, and many people argued that it was unconstitutional. James Madison was one of the most prominent opponents of the tax, and he wrote a pamphlet in 1794 arguing that the tax was unconstitutional.

4.4 out of 5

| Language | : | English |

| File size | : | 2916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 46 pages |

| Lending | : | Enabled |

Madison's Argument

Madison's argument against the Carriage Tax was based on the fact that the tax was a direct tax. Direct taxes are taxes that are levied directly on individuals, such as income taxes and property taxes. According to the Constitution, direct taxes must be apportioned among the states according to their population. This means that each state must pay a share of the tax that is proportional to its population.

The Carriage Tax was not apportioned among the states according to their population. Instead, the tax was levied at a flat rate on all carriages. This meant that states with large populations, such as Virginia, paid a much larger share of the tax than states with small populations, such as Rhode Island.

Madison argued that this was unconstitutional because it violated the principle of apportionment. He argued that the Carriage Tax was a direct tax that was not apportioned among the states according to their population, and therefore it was unconstitutional.

The Supreme Court's Decision

The Supreme Court ruled on the constitutionality of the Carriage Tax in the case of Hylton v. United States (1796). The Court ruled that the tax was constitutional because it was an indirect tax, not a direct tax. Indirect taxes are taxes that are levied on goods or services, such as sales taxes and excise taxes. Indirect taxes do not have to be apportioned among the states according to their population.

The Supreme Court's decision in Hylton v. United States was a major victory for the federal government. It meant that the federal government could impose indirect taxes without having to apportion them among the states according to their population. This gave the federal government much more flexibility in raising revenue.

The Carriage Tax was a controversial tax that was ultimately ruled constitutional by the Supreme Court. James Madison's argument against the tax was based on the fact that it was a direct tax that was not apportioned among the states according to their population. The Supreme Court ruled that the tax was constitutional because it was an indirect tax.

The Carriage Tax was a significant event in the early history of the United States. It helped to establish the principle that the federal government could impose indirect taxes without having to apportion them among the states according to their population. This principle has been upheld by the Supreme Court in subsequent cases, and it remains an important part of the American tax system today.

4.4 out of 5

| Language | : | English |

| File size | : | 2916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 46 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Chapter

Chapter Story

Story Genre

Genre Reader

Reader Paperback

Paperback E-book

E-book Newspaper

Newspaper Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Bestseller

Bestseller Classics

Classics Library card

Library card Autobiography

Autobiography Memoir

Memoir Reference

Reference Narrator

Narrator Character

Character Librarian

Librarian Card Catalog

Card Catalog Borrowing

Borrowing Stacks

Stacks Archives

Archives Periodicals

Periodicals Research

Research Journals

Journals Interlibrary

Interlibrary Literacy

Literacy Study Group

Study Group Thesis

Thesis Book Club

Book Club Theory

Theory Textbooks

Textbooks Alex Crowley

Alex Crowley Robert Marsh

Robert Marsh James P Pfiffner

James P Pfiffner Corinne Michaela Flick

Corinne Michaela Flick Karen Leland

Karen Leland Melanie Metzenthin

Melanie Metzenthin Danielle Steel

Danielle Steel D B Lawhon

D B Lawhon Wendy Wax

Wendy Wax Anne Freytag

Anne Freytag Timothy J Demy

Timothy J Demy John Cloud Henry Townsend

John Cloud Henry Townsend Anne Laure Amilhat Szary

Anne Laure Amilhat Szary S D Robertson

S D Robertson J D Cortese

J D Cortese Quinn Larson

Quinn Larson Edward M Lerner

Edward M Lerner Seyom Brown

Seyom Brown Roger Hutchinson

Roger Hutchinson Annie Douglass Lima

Annie Douglass Lima

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

W.B. YeatsFollow ·17.8k

W.B. YeatsFollow ·17.8k Herman MelvilleFollow ·6.8k

Herman MelvilleFollow ·6.8k Joel MitchellFollow ·5.2k

Joel MitchellFollow ·5.2k Lee SimmonsFollow ·11.9k

Lee SimmonsFollow ·11.9k Alfred RossFollow ·14.8k

Alfred RossFollow ·14.8k Harry CookFollow ·8.8k

Harry CookFollow ·8.8k Thomas HardyFollow ·19.3k

Thomas HardyFollow ·19.3k Cameron ReedFollow ·6.1k

Cameron ReedFollow ·6.1k

Anton Chekhov

Anton ChekhovClarinet Fundamentals: A Systematic Fingering Course for...

Welcome to the exciting world of...

Gage Hayes

Gage HayesSea Prayer: A Haunting and Heartbreaking Story of...

Sea Prayer, the latest...

Henry Green

Henry GreenPillars of Society Rosmersholm Little Eyolf When We Dead...

Henrik Ibsen, the towering...

Robert Reed

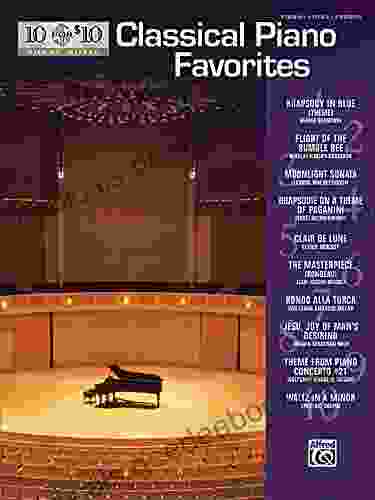

Robert Reed10 For 10 Sheet Music Classical Piano Favorites: A...

Learning to play the...

4.4 out of 5

| Language | : | English |

| File size | : | 2916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 46 pages |

| Lending | : | Enabled |